Mary was near 70 years old and desperate to sell her small clothing manufacturing business.

She wanted to retire and move halfway across the world and not worry about her business anymore.

She had no children, and her extended family were mostly useless so passing down the business to them was not really an option.

She had received an offer for her business, but it was too low.

We got involved and in a few months, we were able to position herself and the business to receive much higher offers by helping with the niching down and effective communication of the value her business would bring.

But there was a problem.

Her finance guy was as effective as the cheaply made toy my 4-year-old insisted we buy her, and which of course broke down in less than 24 hours.

(it was a great lesson for her as we showed her the importance of value and quality, but I digress…).

For example, I asked him for the company’s last 36 trailing months PNL which he should have been able to immediately generate on the quick books platform the owner was paying to subscribe on.

He ignored me.

When I asked again he complained to the owner that it would take a lot of work. She then asked me to just use the last annual financial statements to make the projections.

The problem is that she had a record 9 months of profits that were produced after the timing of the last audited statements.

He still refused to provide the financials and she didn’t want to upset him.

Despite that we were able to make the projections and get her an offer over $2 million USD higher than what she had before.

She was happy but I warned her that her financial guy would be a disaster during due diligence and should be replaced.

She didn’t listen because he was “affordable” and “checked the boxes” she needed, thanked me and paid me for helping her get the offer she wanted and then moved on.

And what I predicted happened.

He was a disaster in due diligence.

Eventually she got rid of him and brought in professionals to help her with the books and to present the numbers professionally.

But the buyer wasn’t waiting around and left the deal.

It was months before she found someone else, but she had to close the deal about $1 million lower than what she had before.

Her “affordable” finance guy turned out to be a $1 million dollar boondoggle.

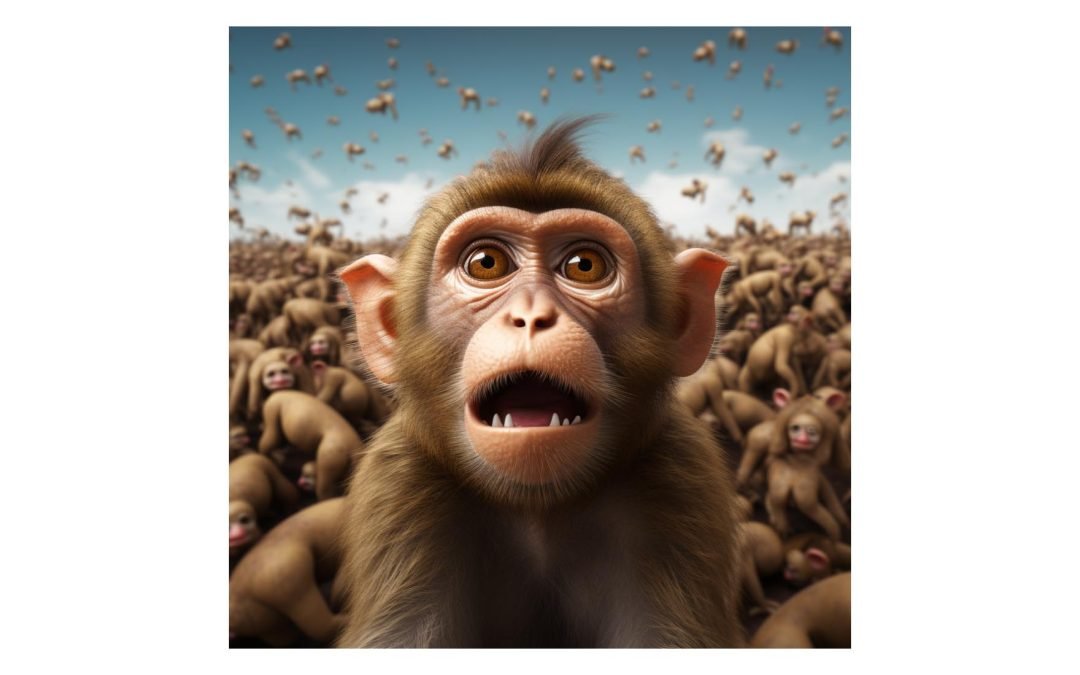

Which reinforces the saying… “Pay peanuts and you get monkeys”

It’s never a smart investment to put your future in the hands of a zoo.

———————–

P.S. I work with small business owners who feel overworked, frustrated and stuck. They’ve looked for help before but have been let down by empty promises and no results.

That’s when they find me. I guide them on exactly how to invest their time and money to transform their business to give them the life they want.

Instead of more ideas and tactics, we provide actionable insights they can easily implement to generate more cash, make their business more valuable, and position themselves to capture those life-changing opportunities.

They just need to be willing to invest in themselves, take decisive action, and break free from old habits.

But don’t take my word for it. Find out more by clicking my LinkTree to check out my different services and resources.